Dear Friends,

I hope this message finds you in good spirits.

At BETI Association, our mission is to uplift and empower girls through education. Your support plays a pivotal role in this mission. By investing in a girl’s education, you help her become stronger, self-reliant, and capable of achieving her dreams. With your contributions, we have been able to provide scholarships,educational supplies, and mentorship to over 2,800 girls since 2017.

Additionally, we’ve offered critical support, including medical care and job placements, to survivors of acid attacks and rape since 2006. To continue expanding our impact and reach more girls in need, we need your help. Your donation will directly contribute to transforming lives and creating a future where every girl has the opportunity to succeed.

Join us in making a lasting difference. Your support is crucial in driving this change.

Thank you for your generosity and commitment

Your Donation Educates and Empoers. Shape Her Future.

Anu Ranjan – Founder

Beti Assocaition – Charity for Women

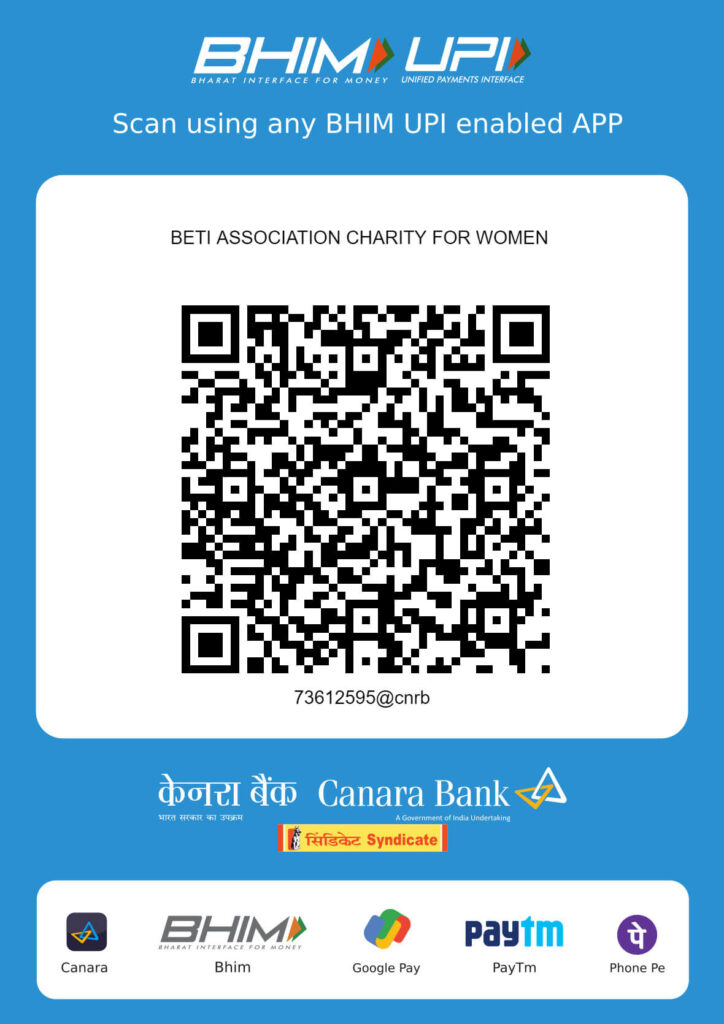

Payment Method: Bank Transfer – RTGS \ Cheque (Details mentioned below)

For Bank Transfers:

For Bank Transfers:

Name of Account: Beti Association – Charity for women

Current Account Number: 0171201010862

Bank: Canara Bank

Branch: Versova, Mumbai

IFSC Code: CNRB0000171

Thank you for your generous support!

Beti Association- Charity for women

Phone: +91 9152291022 [WHATSAPP ONLY]

Registration Details

- Beti Association is registered with the Income Tax Department under section 12A.

- Registration number: AAFCB3384EE20211

- Valid till: A.Y. 2026-27

- All contributions to Beti are eligible for Tax Exemption under section 80G of the Income Tax Act.

- Registration number: AAFCB3384EF20211

- Valid till: A.Y. 2026-27 Donations made and expenditures incurred towards CSR activities are eligible for deduction under section 80G of the Income Tax Act.

- Donations made and expenditures incurred towards CSR activities are eligible for deduction under section 80G of the Income Tax Act.

This is the impact YOU helped us achieve in 2023-24

Education

- Education: 2,830 students

- Medical: 113 students

- Health and Nutrition: 670 students

- Total Students: 3,613

Health & Nutrition

Nutritious Meals:

We provide balanced meals that offer essential vitamins and minerals.

Health Support:

Our programs address immediate hunger and promote long-term health.

Quality Assurance:

We partner with local suppliers and volunteers to ensure high standards.

Commitment:

We aim to improve the quality of life for individuals and families in need.